you can win a hundred battles without a single loss.

If you only know yourself, but not your opponent, you may win or may lose.

If you know neither yourself nor your enemy, you will always endanger yourself.”

– Sun Tzu

Let’s talk about several methodologies.

Line-of-Business Analysis

1. The threat of substitute products or services

2. The threat of the entry of new competitors

3. The intensity of competitive rivalry

4. The bargaining power of customers (buyers)

5. The bargaining power of suppliers

1. What products do you make?

2. Whom do you compete with?

3. How well do you know your competitors?

4. Where is your product positioned relative to them?

5. How do you beat them?

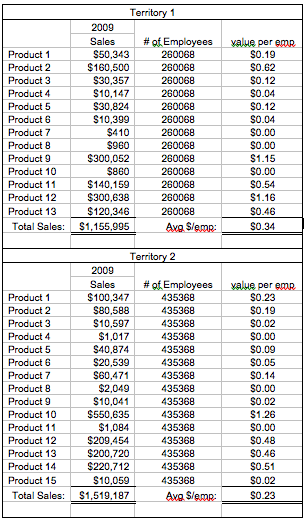

A Real World Example

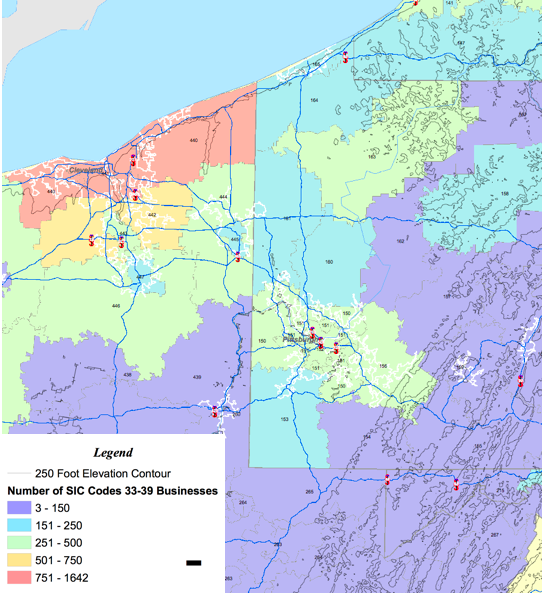

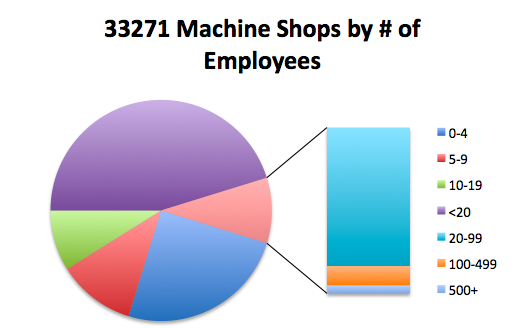

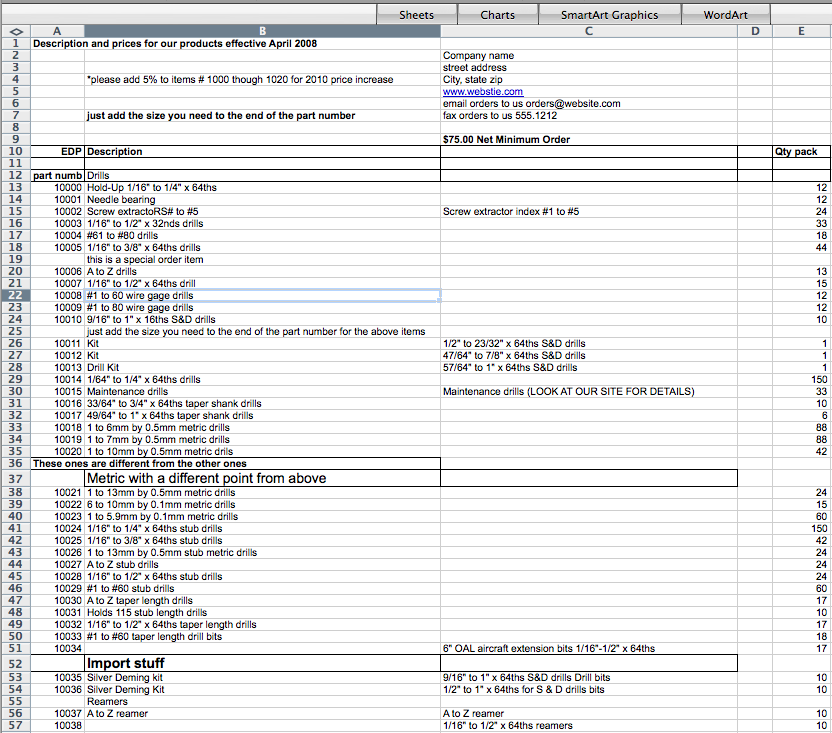

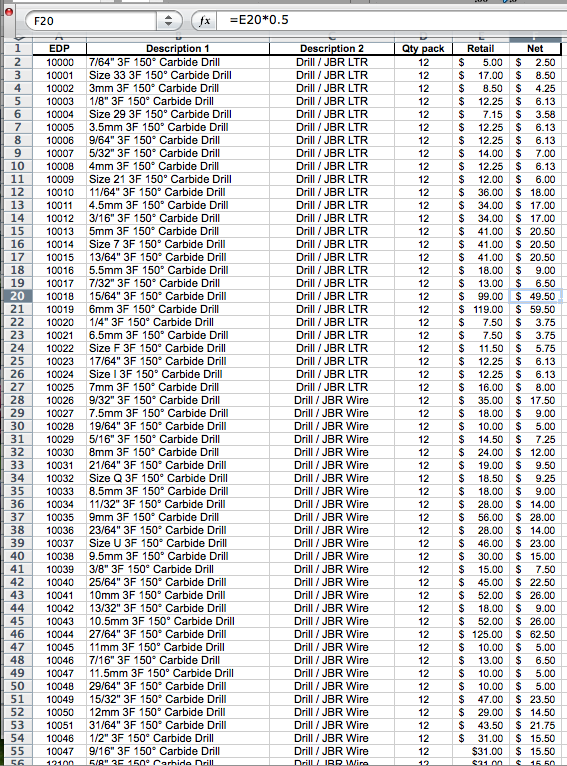

You make carbide end mills as a primary product and you have an offering of carbide burrs. Is the "burrs" product group going to be competitive?

| Your Products:

Who are your competitors in EACH category?

What you might start with may look like something pictured here on the right. Now if your primary product is making end mills and you “dabble” in making burrs how are you going to compete with someone who makes all of the following:

|

So you’ll have some decisions to make:

Do you expand the offering so it is more complete?

Do you just keep the offering where it is at right now?

Are you willing to accept the fact that you will lose some orders within your channel if you don't expand?

At the outset you might not know. But, that’s not important. What’s important is that you MAKE A PLAN. Then take the plan to the field. See what feedback you get and ADJUST TO MEET THE MARKET NEEDS.

There’s a great company that does Line-of-Business analysis for you. It might be worth a few minutes of your time to take a look at their website. They’re called : eCompetitors: Global Industry Dashboard

OODA vs. PDCA

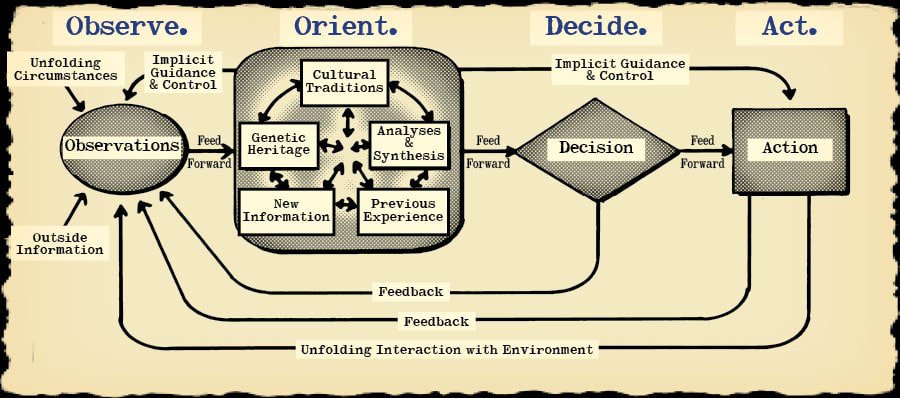

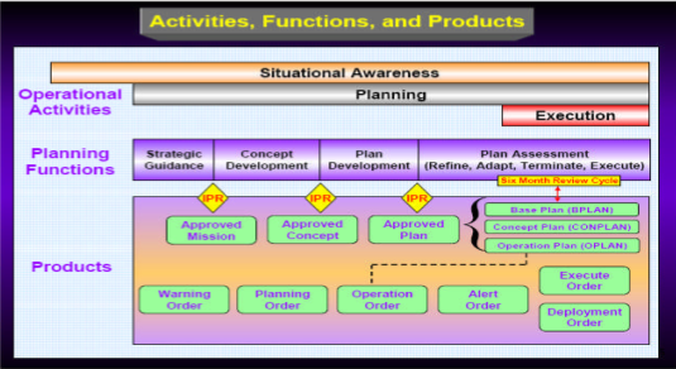

Observe, Orient, Decide, Act is a concept originally applied to the combat operations process, often at the strategic level in military operations. It is now also often applied to understand commercial operations and learning processes. The concept was developed by USAF Colonel John Boyd. In the fast paced world of business competition it’s a good idea to understand how fighter pilots are trained.

Boyd developed the OODA loop concept to explain how to direct one’s energies to defeat an adversary and survive. Boyd emphasized that “the loop” is actually a set of interacting loops that are to be kept in continuous operation during combat. He also indicated that the phase of the battle has an important bearing on the ideal allocation of one’s energies. Basicially it comes down to this:

When the enemy aircraft comes into radar contact, more direct information about the speed, size, and maneuverability, of the enemy plane becomes available; unfolding circumstances take priority over radio chatter. A first decision is made based on the available information so far: the pilot decides to “get into the sun” above his opponent, and acts by applying control inputs to climb. Back to observation: is the attacker reacting to the change of altitude? Then to orient: is the enemy reacting characteristically, or perhaps acting like a noncombatant? Is his plane exhibiting better-than-expected performance?

Plan, Do, Check, Act is an iterative four-step problem-solving process typically used in business process improvement. It is also known as the Deming cycle

- PLAN – Establish the objectives and processes necessary to deliver results in accordance with the expected output. By making the expected output the focus, it differs from other techniques in that the completeness and accuracy of the specification is also part of the improvement.

- DO – Implement the new processes. Often on a small scale if possible.

- CHECK – Measure the new processes and compare the results against the expected results to ascertain any differences.

- ACT – Analyze the differences to determine their cause. Each will be part of either one or more of the P-D-C-A steps. Determine where to apply changes that will include improvement. When a pass through these four steps does not result in the need to improve, refine the scope to which PDCA is applied until there is a plan that involves improvement.

Now put on your thinking cap for a minute. Let’s pretend that you make burrs as a ‘convenience’ to some customers. You’ve discovered that you’ve really been able to cut down your production cost. So much so that you make a very healthy margin on the ones you do sell.

You have a competitor who started off making burrs. It’s their core competency. It’s where they got where they are and NOW they are is starting to make end mills: your core competency. What do you do?

Use the loops: Do the ACT part!

One possibility is that you offer a low price volume promo to your distributors in certain markets to get them promoting your burrs. Target THEIR core competency! Go after them where is hurts. Go after them in their strongest market. BUT, make it a feint: While they are busy trying to keep marketshare, you can expand your business in your core markets.

Don’t be afraid of any of the processes listed. I’ve heard manufacturers say “I’m just a small company, that stuff is for big companies” My response is generally along the lines of “How do you think those companies got to be big companies?”

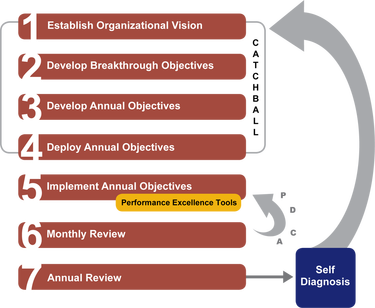

Finally, take a look at some other process’ that are out there. If you can use an already created template to do the reviews and analysis then grab them and utilize them. The Hoshin Strategic Planning process is a good starting point.

Hoshin Strategic Planning

| “The hoshin process is, first of all, a systematic planning methodology for defining long-range key entity objectives. These are breakthrough objectives that typically extend two to five years with little change. Second, the hoshin process does not lose sight of the day-to-day “business fundamental” measures required to run the business successfully. This two-pronged approach provides an extended period of time for the organization to focus its breakthrough effort while continuously improving key business processes day to day.” |

RSS Feed

RSS Feed